Professional-Grade Retirement Planning Software

For People Who Don’t Need a Financial Advisor

You’ve built a seven-figure portfolio. You understand tax brackets, sequence of returns risk, and why IRMAA matters. You don’t need someone to explain dollar-cost averaging or sell you a target-date fund.

What you need: The same modeling tools advisors use - without the 1% AUM fee or the simplified “consumer software” that treats you like you’re financially illiterate.

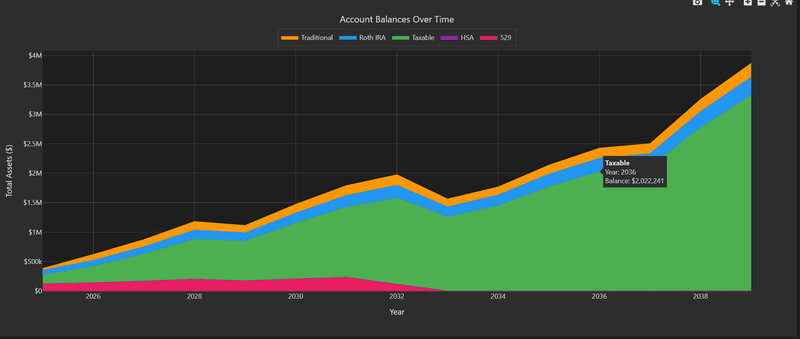

What you get: Desktop software that models the complex scenarios that actually matter to your retirement. Roth conversion ladders. TCJA expiration impacts. IRMAA threshold management. Withdrawal sequencing across account types.

Your data never leaves your computer. You own the software. One price. No subscriptions.

Tax Laws Changed in 2025. Your Calculator Shouldn't Be Stuck in 2024.

The TCJA→OBBBA transition just proved why editable tax parameters matter. When OBBBA passed in July 2025, most retirement software became obsolete overnight. Fatboy users updated their tax parameters in 10 minutes and kept planning.

Tax laws will change again. Probably in 2027-2028. When they do, you'll be ready. Read why this matters →

Why Sophisticated Planners Choose Fatboy

Tax Modeling That Doesn’t Insult Your Intelligence

Model OBBBA senior deduction strategies (2026-2028). Edit federal and state tax parameters yourself. See exactly how a $50k Roth conversion impacts your taxes this year, your IRMAA brackets at 65, and your RMDs at 75. Compare strategies side-by-side with full tax implications flowing through every projection.

This isn’t a calculator with hardcoded 2024 tax brackets. It’s a modeling engine you control. When tax laws change, you update the parameters yourself - no waiting 6-18 months for vendor updates.

“What If” Analysis That Actually Works

- Retire at 62 vs 65 vs 67 - full cash flow impact

- Roth conversion strategies year-by-year

- Pay off mortgage early vs invest the difference

- Semi-retirement with part-time income

- Healthcare costs before Medicare

- Different spending levels (lean / baseline / comfortable)

Every scenario change propagates through taxes, account balances, Social Security timing, and long-term outcomes. You can see the tradeoffs, not just a “probability of success” number.

Find Your Plan’s Breaking Points (Pro Feature)

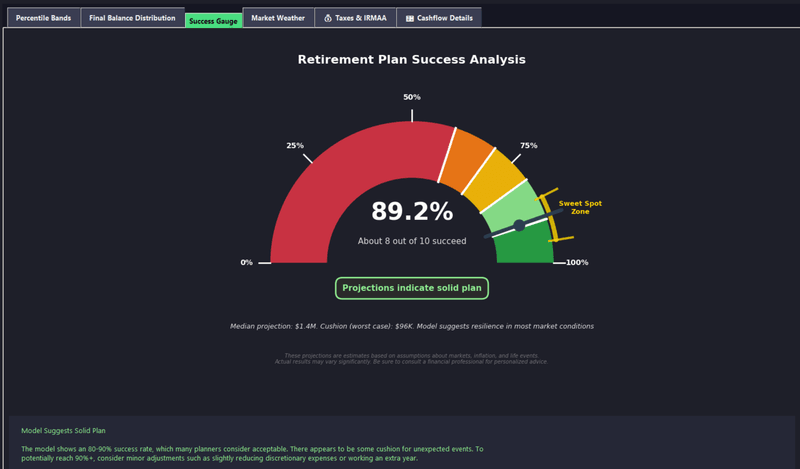

Stop wondering “am I being too conservative?” or “is this sustainable?”

Breakpoint Analysis tells you exactly where your plan fails:

- How low can returns go before you run out of money?

- What’s the maximum safe withdrawal rate for YOUR portfolio?

- Which assumptions actually matter vs which are just noise?

Interactive stress testing with color-coded risk zones. Sensitivity analysis that separates real risks from worries.

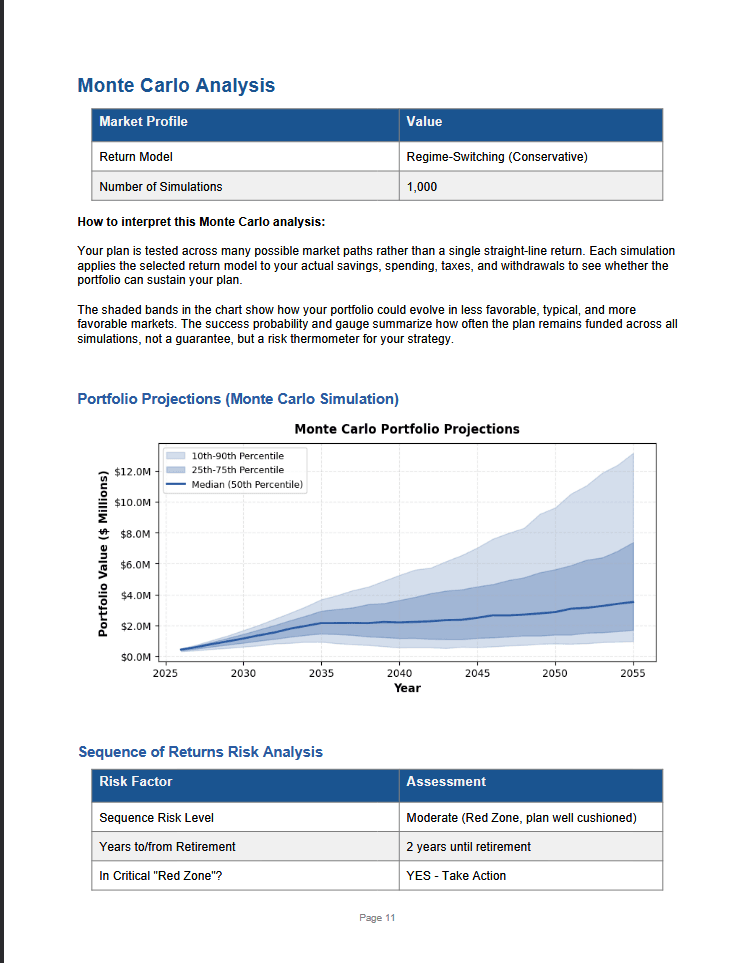

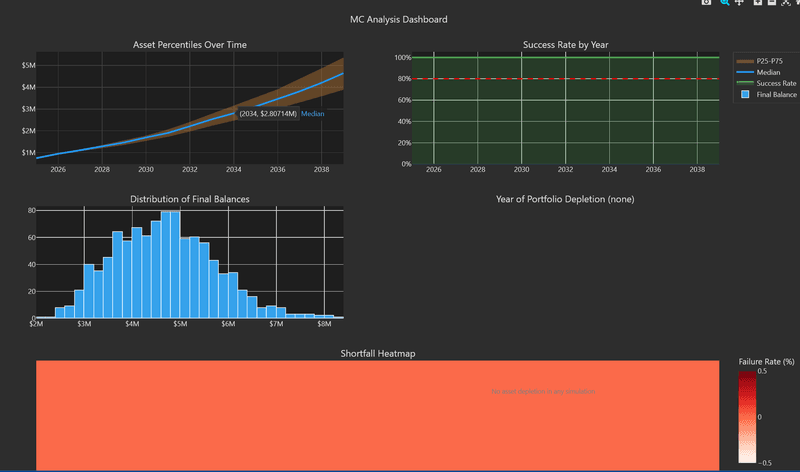

Monte Carlo Simulations Built for Planners

Not the dumbed-down version. Full control over:

- Asset allocation by account type

- Volatility assumptions

- Return sequences

- Number of iterations

- Risk-free rate assumptions

See percentile outcomes (10th, 25th, median, 75th, 90th) - not just a single “success rate.”

Professional Plan Summary Reports (Pro)

Generate polished, client-ready PDFs of your analysis. Perfect for:

- Couples who want to review plans together

- Sharing with a CPA or tax advisor for validation

- Documenting your strategy for future reference

- Financial advisors who need professional deliverables

Executive summary, detailed projections, Monte Carlo analysis, sequence-of-returns risk, and compliance-friendly disclosures. All formatted for professional presentation.

How It Works

1. Input your situation

Accounts, income sources, expenses, debts. Your assumptions on returns, inflation, salary growth.

2. Build and compare scenarios

Different retirement dates. Roth strategies. Withdrawal orders. Tax law changes. Lifestyle variations. See side-by-side comparisons with full details.

3. Stress test and refine

Monte Carlo simulations. Breakpoint analysis (Pro). Find where your plan is vulnerable and where you have margin for error.

4. Document your strategy (Pro)

Export professional reports. Share with advisors. Review annually. Adjust as life changes.

See the Software In Action

Color-coded success probability with risk zones - at a glance assessment of plan viability

Monte Carlo simulation showing distribution of outcomes across thousands of scenarios

Long-term asset trajectories comparing different strategies and spending levels

View All Screenshots - Portfolio analysis, cash flow projections, tax modeling, goal planning, and more.

Pricing That Makes Sense

Free Version: Full planning capability. 3 scenarios. Core features unlocked. This isn’t a trial - it’s genuinely useful software.

Pro Version - $149 (One-Time):

- Unlimited scenarios

- Breakpoint analysis & stress testing

- Professional PDF reports

- Advanced Monte Carlo controls

- Sensitivity analysis

- All future updates included

No subscriptions. No annual “update” fees. You own it.

Compare that to advisor fees (1% of $1M = $10,000/year) or subscription software ($20-50/month forever). This pays for itself immediately.

See Detailed Comparison with other retirement planning software.

Your Data, Your Computer

Desktop application. Everything runs locally. No cloud sync. No “storing your data for your convenience.” No harvesting your financial information to train AI models or sell to marketers.

System Requirements:

- Windows 10/11 (fully supported)

- Linux (beta available)

- macOS (coming soon)

- 4GB RAM recommended

- 1366x768 display minimum (realistically: get a bigger monitor for this kind of work)

- Internet optional (only for tax data updates)

Who This Is For

✓ Engineers, executives, and professionals with 7-figure portfolios who understand their finances

✓ DIY investors who want advisor-level tools without advisor fees

✓ Fee-only financial planners who need professional software without SaaS pricing

✓ Anyone planning Roth conversions and tired of spreadsheets

✓ Pre-retirees modeling TCJA 2026 impacts on their tax strategy

❌ People who need someone to tell them what to invest in

❌ Anyone looking for portfolio management or investment advice

❌ People who want their phone to make financial decisions for them

Get Started

Download Free Version (Windows)

| Why Fatboy? | Blog | Pricing | About |

Questions? Email: fbfinancialplanner@gmail.com Note: Linux version available. Code signing certificate for download trust indicators in process.